Roth Conversion Software: Finding the Best Tool for Your Tax Strategy

By Zach Lundak | January 9, 2026

Roth conversions are arguably the most powerful tax-planning strategy available to retirees. If executed properly, they can save you and your family hundreds of thousands of dollars in lifetime taxes. But how do you decide exactly how much to convert?

Today, I’m evaluating the most popular tools on the market—from DIY favorites to professional advisor software—to see which ones actually help you move the needle.

You can watch my YouTube video on this topic here.

The Evaluation Scorecard

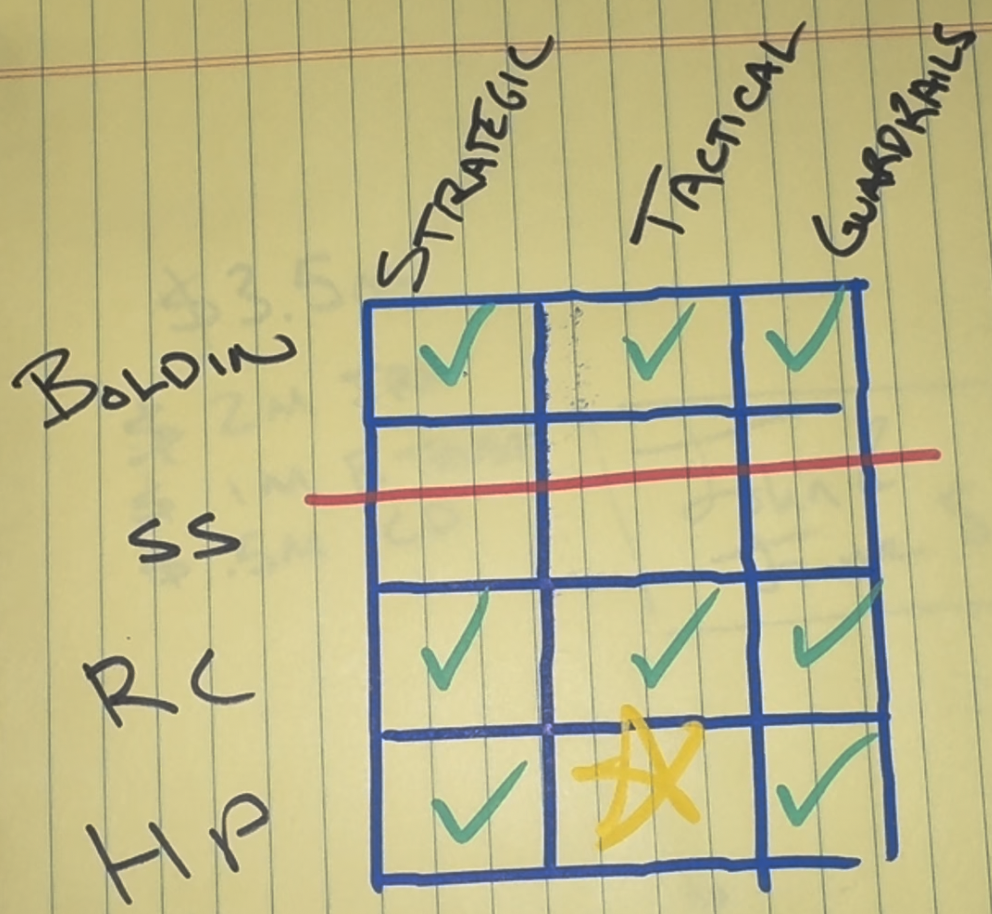

To judge these tools, I look at three specific metrics:

Strategic: Does the tool help me understand the "why" before I get lost in the numbers?

Tactical: Can I use this to find the exact dollar amount to convert this year?

Guardrails: Does it stop me from making a massive mistake (like accidentally triggering a massive IRMAA penalty)?

Our Case Study

To test these tools, we used a sample couple:

Age: 60 (Retired this year).

Assets: $3.5 Million ($2M in a traditional IRA, $1M in a trust, $500k in cash).

Timeline: Social Security at 67; RMDs at 75.

Spending: $8,000 to $15,000 per month.

1. Boldin (The DIY Powerhouse)

Boldin (formerly NewRetirement) is a "pro-sumer" favorite.

The Strategic Win: Boldin immediately asks what your goal is: "Lowest Lifetime Taxes," "Limit IRMAA Brackets," or "Max Estate Value." This is a huge win for strategy.

The Findings: In our case study, Boldin’s unconstrained model suggested converting the entire $2M IRA in just four years. While mathematically sound for minimizing lifetime taxes, it required writing $200k+ checks to the IRS annually—a bold move that most DIYers would want a second set of eyes on.

Verdict: Excellent for strategy and guardrails.

2. Manual Spreadsheets (The "No-Go" Zone)

I strongly advise against using a manual spreadsheet for Roth planning.

Errors: One broken formula can ruin your plan, and they are notoriously hard to find in dense tabs.

Assumptions: You have to manually build inflation, tax law changes, and bracket shifts.

Time Value: Your time in retirement is too valuable to spend debugging a spreadsheet that software companies have already spent millions perfecting.

3. Right Capital (The Advisor Foundation)

Right Capital is a professional tool I use in my practice.

The Strategic Win: It has an "Opportunities" tab that automatically solves for the best conversion strategy to lower lifetime taxes.

Tactical Ease: It allows me to model "filling up" specific tax brackets (like the 22% or 24% bracket) and then immediately see how that choice changes the client's long-term probability of success.

4. Holistiplan (The Tactical Gold Standard)

Holistiplan is widely considered the best tool for the "Tactical" piece of the puzzle.

Visualizing the "Cliffs": Unlike other tools, Holistiplan lets you see the specific "Tax Torpedoes" and "Cliffs." It shows you exactly where an extra dollar of conversion triggers a phase-out of a credit or a jump in Medicare premiums (IRMAA).

Precision: If you want to convert "up to the dollar" of a specific tax bracket without going a penny over, Holistiplan is the tool that makes it possible.

Summary Scorecard

Which should you use?

If you are a DIYer, Boldin is your best bet for high-level strategy. However, once you get to the "Tactical" stage of actually moving money, you may want to work with an advisor who uses Holistiplan or Right Capital to ensure you aren't walking into a tax minefield.

At Barrett FP LLC, we offer expert financial planning on an hourly basis. We use these professional tools to help you dial in the exact right Roth conversion amount for your situation.