The Rise and Fall of the Roth Conversion Loophole (And Why It’s Still Your Best Move)

By Zach Lundak | January 23, 2026

If you’ve been following retirement planning for a while, you might have heard that Roth conversions "aren't what they used to be." It’s true—there was once a loophole so powerful it felt like cheating.

But even though the IRS eventually caught on and closed that specific door, Roth conversions remain one of the most effective ways for DIY investors to manage their tax brackets in retirement.

Let’s take a look through the history of the Roth IRA and why you should still care about it in 2026. You can also watch my YouTube video on this topic here.

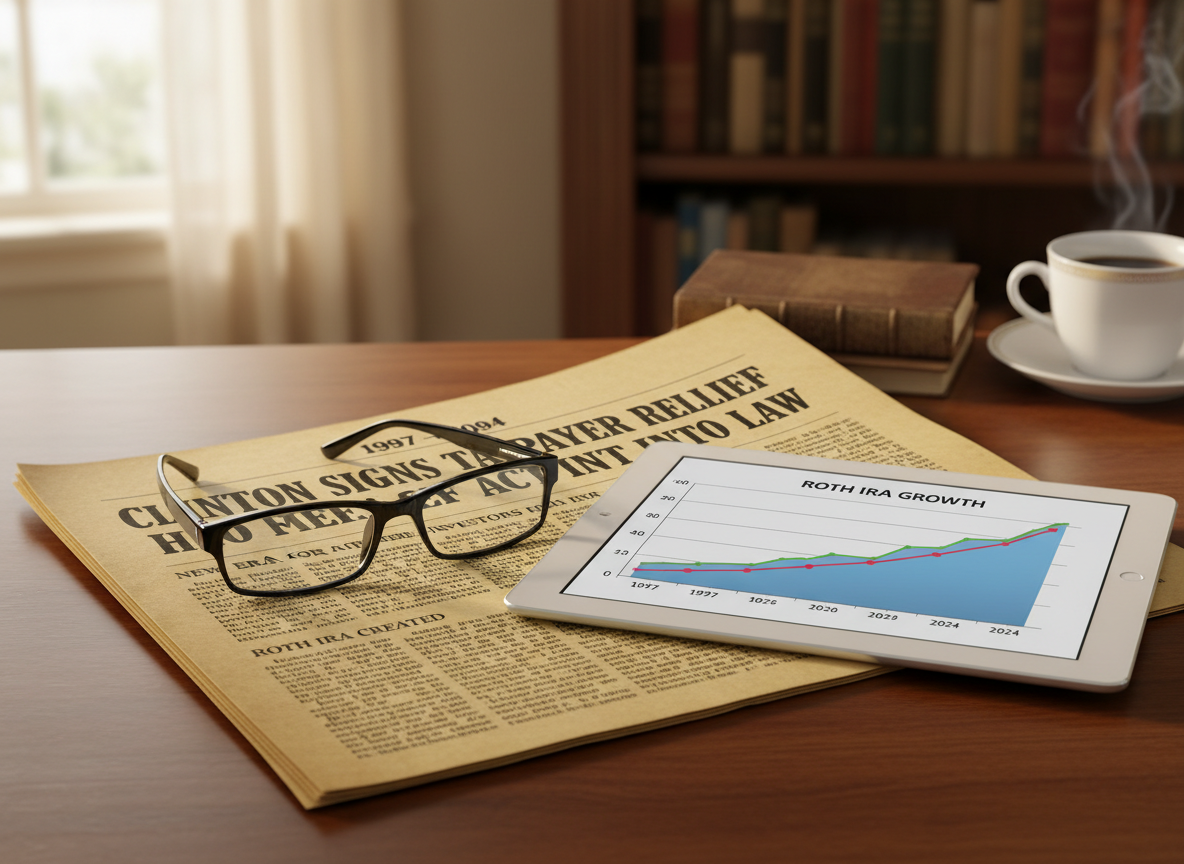

1997: The Birth of the Roth

The Roth IRA was born out of the Taxpayer Relief Act of 1997. It was a unique moment in history—President Clinton was in his second term, working with a Republican-led House and Senate. Together, they passed a suite of tax breaks we still rely on today, including:

The $250k/$500k primary residence capital gains exclusion.

Lowering the top capital gains rate from 28% to 20%.

And, of course, the Roth IRA.

Named after Senator William Roth of Delaware (my second favorite senator, right behind "Senator HSA"), these accounts were originally a bit of a niche tool. The contribution limit was a tiny $2,000 per year, and if you made more than $100,000, you were completely locked out of contributing or converting.

2010: The "Golden Age" of the Re-characterization Loophole

Things got interesting in 2005 when legislation was passed to remove the income cap on conversions, effective in 2010. Suddenly, everyone could convert pre-tax money to Roth, regardless of how much they earned.

But the real "magic" was a loophole called re-characterization.

In the "Golden Age," you could perform a Roth conversion and then, up until you filed your taxes the following year, tell the IRS: "Actually, I changed my mind. Let's unwind that whole deal."

Retirees used this to "game" the market: Imagine you wanted to convert $100,000. You could convert $500,000 across five different asset classes. At the end of the year, you’d look at the performance. If the Tech stocks went up 50% but the Energy stocks went down 20%, you would "re-characterize" (unwind) the four losers and only keep the winner. This allowed you to "skirt" the taxes on the massive gains in the best-performing asset.

2018: The Loophole Closes

The IRS eventually realized they were being "arbitraged." The Tax Cuts and Jobs Act of 2018 officially banned the re-characterization of conversions.

(Note: You can still re-characterize contributions if you accidentally put money in a Roth and realize you made too much, but once a conversion is done, it’s permanent. No more "undo" button.)

Why Roth Conversions Still Matter in 2026

Even without the "undo" button, Roth conversions are your best tool for acting like a Business Owner in retirement.

While high-earning professionals have almost zero control over their tax rates, retirees have a unique window. You can pick and choose when to realize income. By converting assets today, you are:

Defusing the RMD Bomb: Reducing the amount the government forces you to take out (and pay taxes on) at age 75.

Avoiding Tax Torpedoes: Keeping your future income low enough to avoid Social Security taxation spikes and massive IRMAA (Medicare premium) penalties.

Hedging Against Future Rates: Locking in today's relatively low tax rates before they potentially sunset or increase.

Conclusion

The Roth conversion isn't as "sweet" as it was during the re-characterization era, but it is still the primary way to manage your bracket and save your family a ton of money in taxes.

At Barrett FP LLC, we offer expert financial planning on an hourly basis. We can help you look at your historical balances and current brackets to see if a Roth conversion makes sense for your 2026 plan.